There was nothing in or out of the Comex warehouses yesterday with regard to gold bullion.

TFMetals had some very interesting observations on recent actions in the Comex, in which JPM brought in two tranches of perfectly even metric tonnes to their warehouse.

Anyone who knows the nature of actual gold bars in use understands that they are never crafted even to the ounce, and certainly not to the tonne.

And one has to wonder where such a large amount of gold was found outside the Comex in 100 oz bars and/or from what refinery it has recently been certified Comex good. Or were the customary requirements waived for some reason on introducing new bullion bars into the Comex complex for them? Are they self-certifying now?

They are on the quantities. As you know, the CME has added a specific disclaimer to their warehouse report that say they perform no audit or inspection whatsoever on what the Banks might report in bullion, and assume no responsibility.

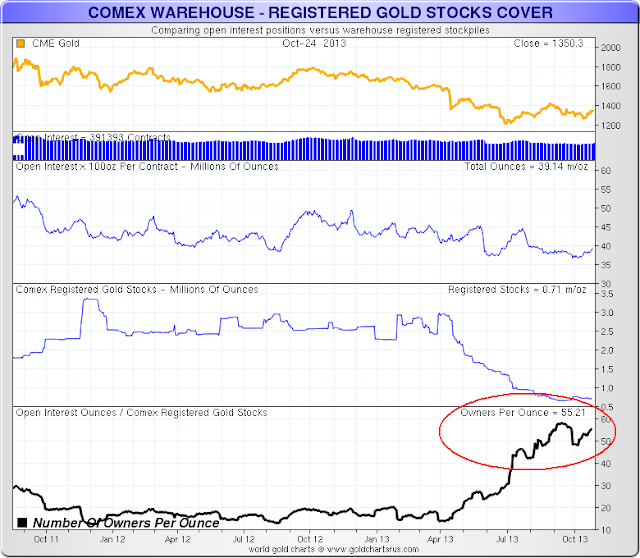

Be all this as it may, the number of claims per ounce of registered metal continues to climb with expanding open interest, and now stands at around 55, which is very high. And about 40 percent of that deliverable gold sits in the JPM managed warehouse.

Given the potential for a dislocation to the exchange, and the widespread gimmickry that has been uncovered with the Banks and their commodity activity, I would like to think that the CME and CFTC might rouse themselves to have a look.

As I recall, someone who is a hero to the markets said, 'trust, but verify.' And the grounds for trust these days are stretched exceptionally thin.

Weighed and found wanting.

Stand and deliver.